Important terms

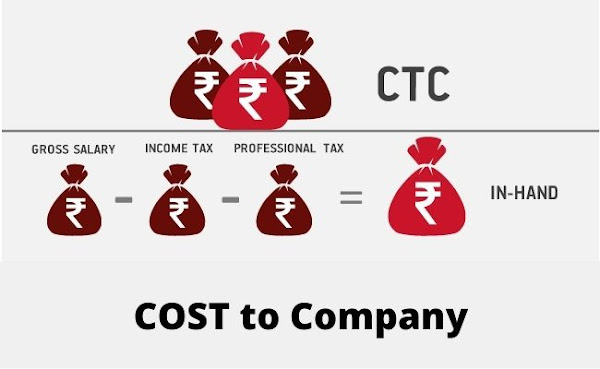

CTC

cost to company

80CC

You can save money up to 150000 ₹ from taxes. If you invest your money in any of these PF, PPF, ELSS or NPS

PF or EPF

Employee providend fund contributed by both company and employee in some ratio to EPF account.

you can get this money when ever planning to retire from job.

PPF

Public providend fund, is a bank account which can be opened with a bank, it has a locking period of 15 years for first time, and then it can be exenteded further with 5 Years locking. just like EPF, PF money is also exempted from income taxes under 80CC section.

Other advantages of saving money to PPF is that up to 150000 is exempted from taxes, it has a good interest rate of 7.8% per anum. and there is not tax on interest earned in PPF account.

ELSS

Equilty linked saving scheme, This also falls in the category of Tax saving under 80CC section.

In this scheme your money is invested in stock market, It is very much simmilar to Mutual Funds. But with 3 to 5 years locking period. You can get tax benifit under 80CC section.

NPS

National pension scheme

إرسال تعليق

Please do not add any SPAM links or unrelated text in comments.